The Department of Economics organizes an intense workshop, where leading experts meet in Verona to discuss recent advances in financial mathematics. Join us!

08 : 30 AM - 08 : 45 AM

08 : 45 AM - 09 : 20 AM

This paper proposes a new nonparametric test for detecting short-lived locally explosive trends (drift bursts) in pure-jump processes. The new test is designed specifically to detect intraday flash crashes and gradual jumps in cryptocurrency prices recorded at a high frequency. Empirical analysis shows that cryptocurrency prices crash much more frequently than the conventional assets. The crashes induce short-term return predictability indicating the inefficiency of crypto markets.

09 : 30 AM - 10 : 05 AM

In the reform of interest rate benchmarks, a central role is played by overnight nearly risk-free rates (RFRs). A key feature of RFRs is the presence of jumps and spikes at periodic time intervals as a result of monetary policy as well as regulatory and liquidity constraints. This corresponds to stochastic discontinuities in the dynamics of RFRs. In this work, we propose a general modelling framework with stochastic discontinuities in an extended HJM setup. We show that the consistency between a RFR and the related term rate can be analysed in terms of a BSDE, whose driver is determined by the HJM drift restrictions. We develop a tractable specification driven by affine semimartingales, also extending the classical short rate approach to the case of stochastic discontinuities providing explicit valuation formulas in a Gaussian setting. Moreover, we study hedging in the sense of local risk-minimization when the underlying term structures have stochastic discontinuities. This is based on joint work with Z. Grbac and T. Schmidt.

10 : 15 AM - 10 : 50 AM

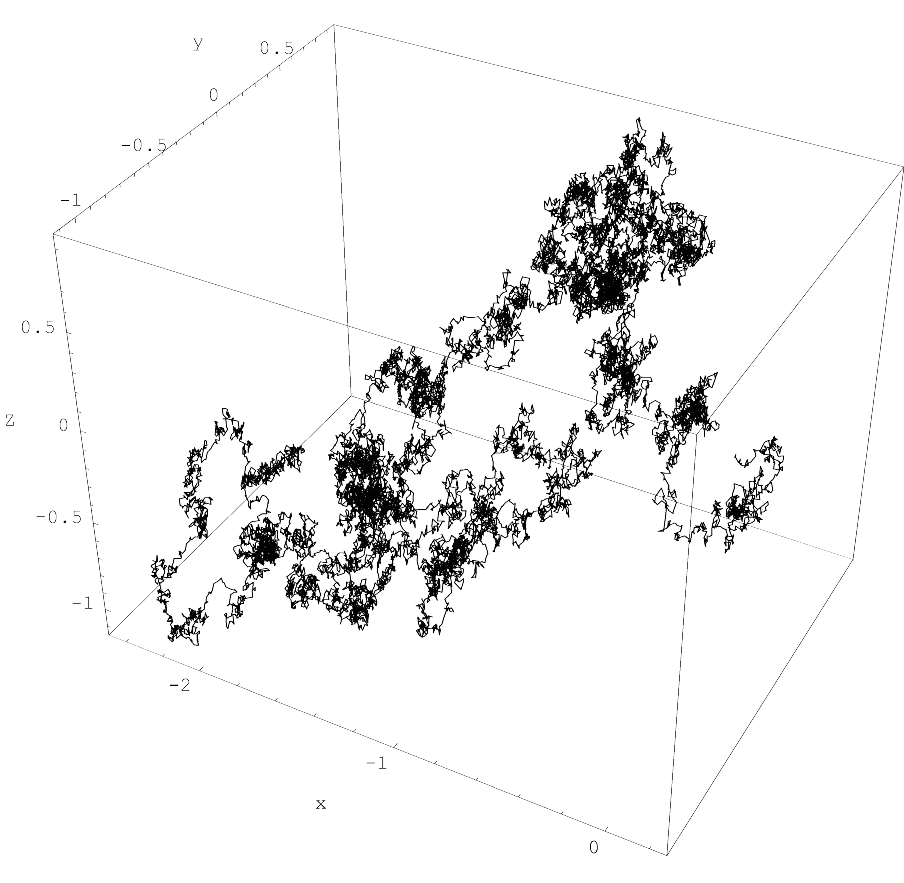

We introduce a framework that allows to employ (non-negative) measure-valued processes for energy market modeling, in particular for electricity and gas futures. Interpreting the process' spatial structure as time to maturity, we show how the Heath-Jarrow-Morton approach can be translated to this framework, thus guaranteeing arbitrage free modeling in infinite dimensions. We derive an analog to the HJM-drift condition and then treat in a Markovian setting existence of non-negative measure-valued diffusions that satisfy this condition. To analyze mathematically convenient classes we consider measure-valued polynomial and affine diffusions, where we can precisely specify the diffusion part in terms of continuous functions satisfying certain admissibility conditions. For calibration purposes these functions can then be parameterized by neural networks yielding measure-valued analogs of neural SPDEs. By combining Fourier approaches or the moment formula with stochastic gradient descent methods, this then allows for tractable calibration procedures which we also test by way of example on market data.

11 : 30 AM - 12 : 05 AM

Protection of creditors is a key objective of financial regulation. Where the protection needs are high, i.e., in banking and insurance, regulatory solvency requirements are employed to prevent that creditors incur losses on their claims. The current regulatory requirements based on Value at Risk and Expected Shortfall help limit the probability and size of default of financial institutions, but fail to control the size of recovery on creditors' claims in the case of default. We address this failure by developing the class of recovery risk measures. In a variety of case studies we analyze how recovery risk measures react to the joint distributions of assets and liabilities on firms' balance sheets and compare the corresponding capital requirements with the current regulatory benchmarks based on Value at Risk and Expected Shortfall. The talk is based on joint work with Stefan Weber (Leibniz University Hannover) and Lutz Wilhelmy (Swiss Re Zurich).

12 : 15 AM - 12 : 50 AM

Modelling joint dynamics of liquid vanilla options is crucial for arbitrage-free pricing of illiquid derivatives and managing risks of option trade books. This talk develops a nonparametric model for the European option book, respecting underlying financial constraints while being practically implementable. We derive a state space for prices which are free from static (or model-independent) arbitrage and study the inference problem where a neural SDE model is learnt from discrete time series data of stock and option prices. We validate our approach with numerical experiments using data generated from a Heston stochastic local volatility model and EURO STOXX 50 index data. A subsequent Value-at-Risk (VaR) backtesting analysis shows better coverage performance and less procyclicality than standard filtered historical simulation approaches. Finally, we derive sensitivity-based and minimum-variance-based hedging strategies. When applied to various portfolios of EURO STOXX 50 index options over usual and stressed market periods, our market models can lead to lower hedging errors than Black-Scholes delta-vega hedging, and are less sensitive to the choice of hedging instruments. This is joint work with Sam Cohen and Sheng Wang (University of Oxford)

Via Cantarane, 24 37129 Verona Italy

+39 045 802 8537