The Department of Economics organizes an intense workshop, where leading experts meet in Verona to discuss recent advances in statistics and econometrics.

09 : 00 AM - 09 : 10 AM

Giam Pietro Cipriani and Cecilia Mancini

09 : 10 AM - 10 : 00 AM

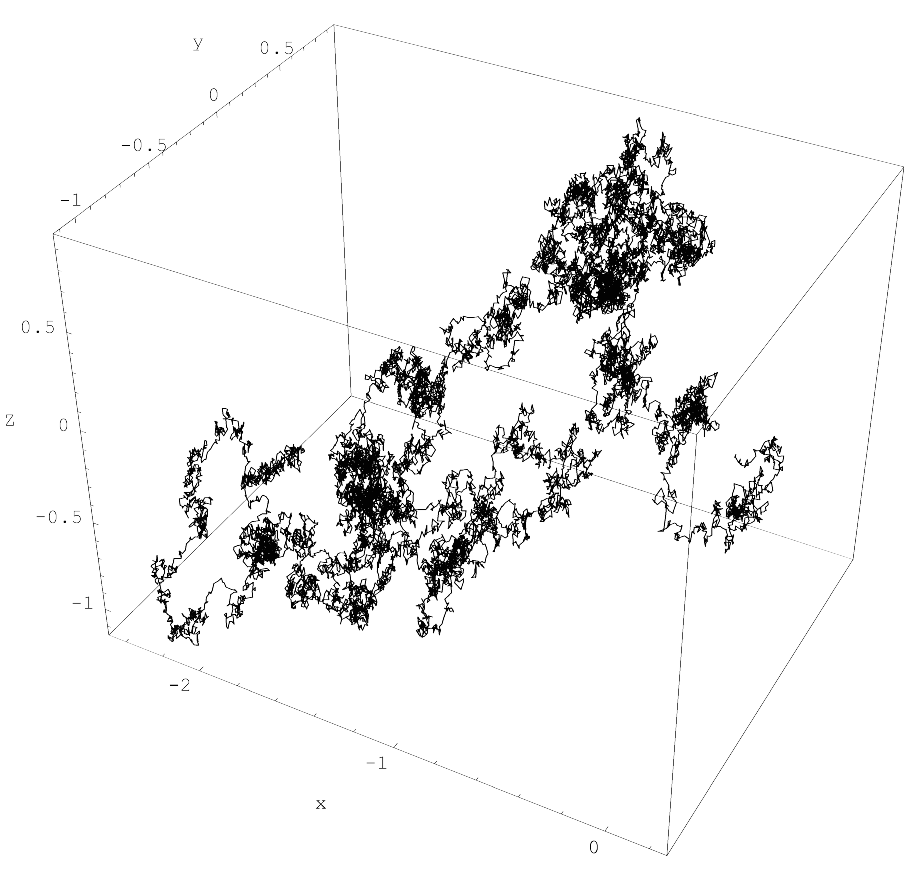

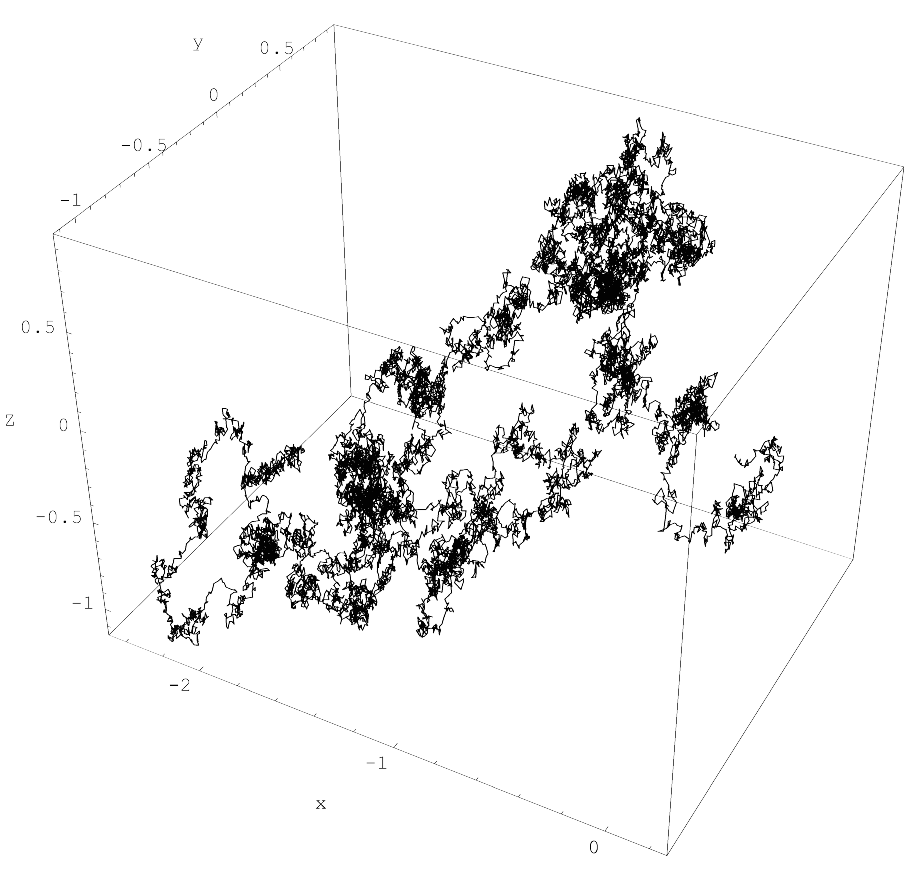

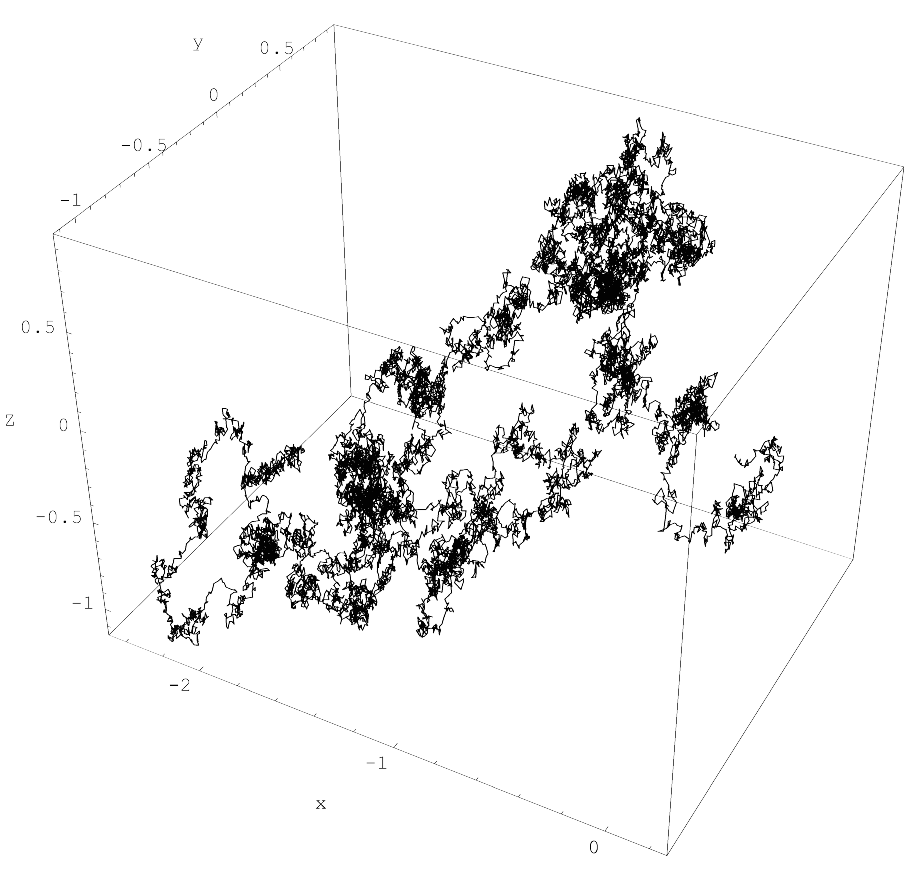

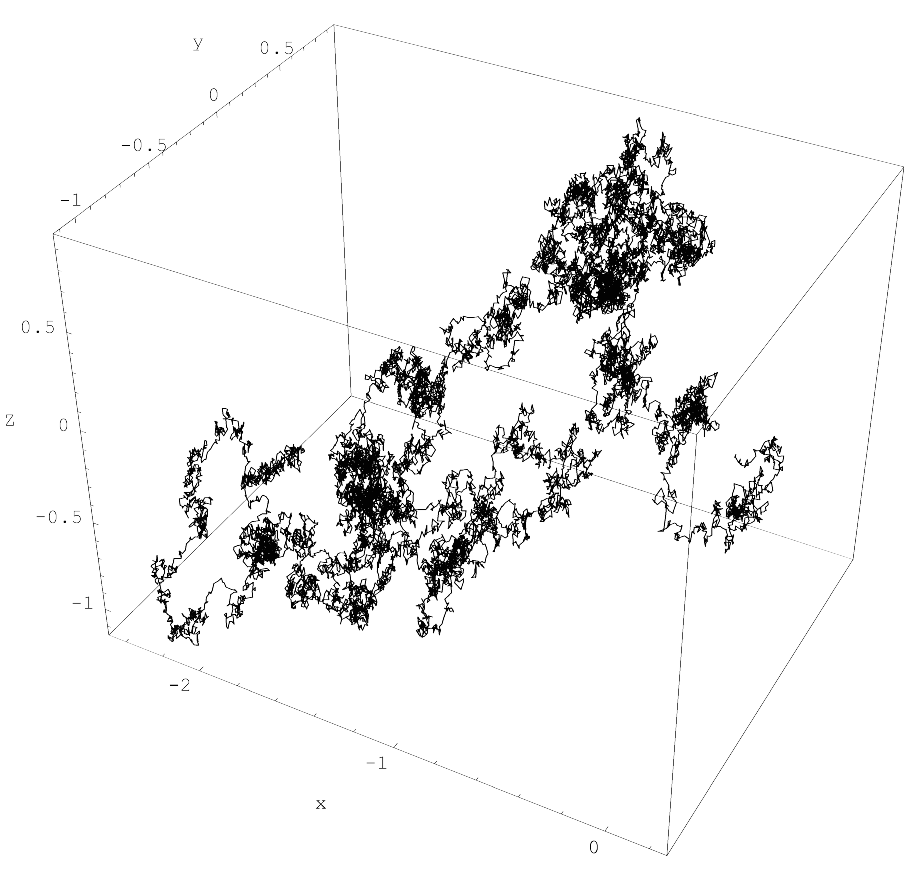

We discuss recent applications of the Malliavin calculus in the aspects of the precise approximation of the distribution of Wiener functionals. Tudor and Yoshida (SPA 2023) presented a general expansion formula for Wiener functionals in the central limit case. This method is exemplified by the applications to the quadratic form of a mixed fractional Brownian motion, a variation of a stochastic wave equation, an estimator for the Hurst coefficient, and an estimator for the fractional Ornstein-Uhlenbeck process. In non-ergodic statistics, the method of expansion for Skorohod integrals by Nualart and Yoshida (EJP2019) is applied to an anticipative quadratic variation and the realized volatility of a fractional diffusion.

By Nakahiro Yoshida Chair: Cecilia Mancini

10 : 00 AM - 10 : 50 AM

We propose a new strategy for adaptation based on heavy-tailed priors. We illustrate it in a variety of settings, showing in particular adaptation with respect to unknown smoothness and structure parameters in the minimax sense (up to logarithmic factors). We present numerical simulations corroborating the theory. This talk is based on works in progress with Sergios Agapiou (Cyprus) and Paul Egels (Sorbonne).

By Ismael Castillo Chair: Marco Minozzo

10 : 50 AM - 11 : 20 AM

11 : 20 AM - 12 : 10 AM

Variational methods are extremely popular in the analysis of network data. Statistical guarantees obtained for these methods typically provide asymptotic normality for the problem of estimation of global model parameters under the stochastic block model. In the present work, we consider the case of networks with missing links that is important in application and show that the variational approximation to the maximum likelihood estimator converges at the minimax rate. This provides the first minimax optimal and tractable estimator for the problem of parameter estimation for the stochastic block model. We complement our results with numerical studies of simulated and real networks, which confirm the advantages of this estimator over current methods.

By Olga Klopp Chair: Catia Scricciolo

12 : 10 AM - 01 : 00 PM

Bayesian methods are becoming increasingly popular in high- and infinite dimensional models. However, standard, MCMC based methods are known to scale badly with the sample size and number of parameters in complex models. Therefore, in practice often variational algorithms are used to approximate the posterior distribution. These methods up to recently were black box procedures with very limited theoretical underpinning. In this talk we discuss the recent theoretical developments for the variational Bayes method and focus on specific examples, including the high-dimensional linear and logistic regression models and Gaussian process regression. The talk is based on a joint works with Kolyan Ray, Gabriel Clara, Harry van Zanten, Dennis Nieman and Thibault Randrianarisoa.

By Botond Szabo Chair: Catia Scricciolo

01 : 00 PM - 2 : 30 PM

02 : 30 PM - 03 : 20 PM

In a 1959 article, Rényi stated a set of axioms defining good measures of dependence and showed that the maximum correlation coefficient fulfilled all of them. However, Rényi’s maximum correlation coefficient can be computed in very few cases. We introduce a sample measure of dependence, a test of independence based on it, and a graphical tool to understand the type of dependence found in the data. The test statistic under the null of independence is distribution-free, asymptotically chi-squared, and simple to compute. There are good reasons to conjecture that the proposed sample measure of dependence converges in probability to the maximum correlation coefficient, and scholars attending the workshop may join me in a formal proof of this convergence.

By Matteo Pelagatti Chair: Francesca Rossi

03 : 20 PM - 04 : 10 PM

This paper studies the identification of a system of linear stochastic differential equations (SDE) under the assumption that the drift process is unobservable and the other state variables are observable at discrete times. The inability to observe the drift gives rise to challenging identification issues making the inference of the SDE parameters significantly more complex compared to the case of observable drift. We find mild restrictions on the drift dynamics allowing to uniquely determine the drift linear projections and other important covariance structures of the SDE. Our results are applied to the problem of continuous-time asset allocation under partial information, showing that they are sufficient to identify the optimal allocation strategy from discrete-time data. We thus conciliate the continuous-time formulation of the asset allocation problem with the econometric inference of the model parameters based on discrete-time information. Using financial data, we finally show that arbitrary or ad hoc parameter restrictions are not necessarily admissible, resulting in sub-optimal allocations hampering the investor's ability to learn about the drift dynamics.

By Giuseppe Buccheri Chair: Francesca Rossi

04 : 10 PM - 04 : 40 PM

04 : 40 PM - 05 : 30 PM

We study a mean field game in continuous time over a finite horizon, T, where the state of each agent is binary and where players base their strategic decisions on two, possibly competing, factors: the willingness to align with the majority (conformism) and the aspiration of sticking with the own type (stubbornness). We also consider a quadratic cost related to the rate at which a change in the state happens: changing opinion may be a costly operation. Depending on the parameters of the model, the game may have more than one Nash equilibrium, even though the corresponding N- player game does not. Moreover, it exhibits a very rich phase diagram, where polarized/unpolarized, coherent/incoherent equilibria may coexist, except for T small, where the equilibrium is always unique. We fully describe such phase diagram in closed form and provide a detailed numerical analysis of the N-player counterpart of the mean field game. Joint work with Marco Tolotti (Venezia) and Elena Sartori (Padova).

By Paolo Dai Pra Chair: Nakahiro Yoshida

05 : 30 PM - 06 : 20 PM

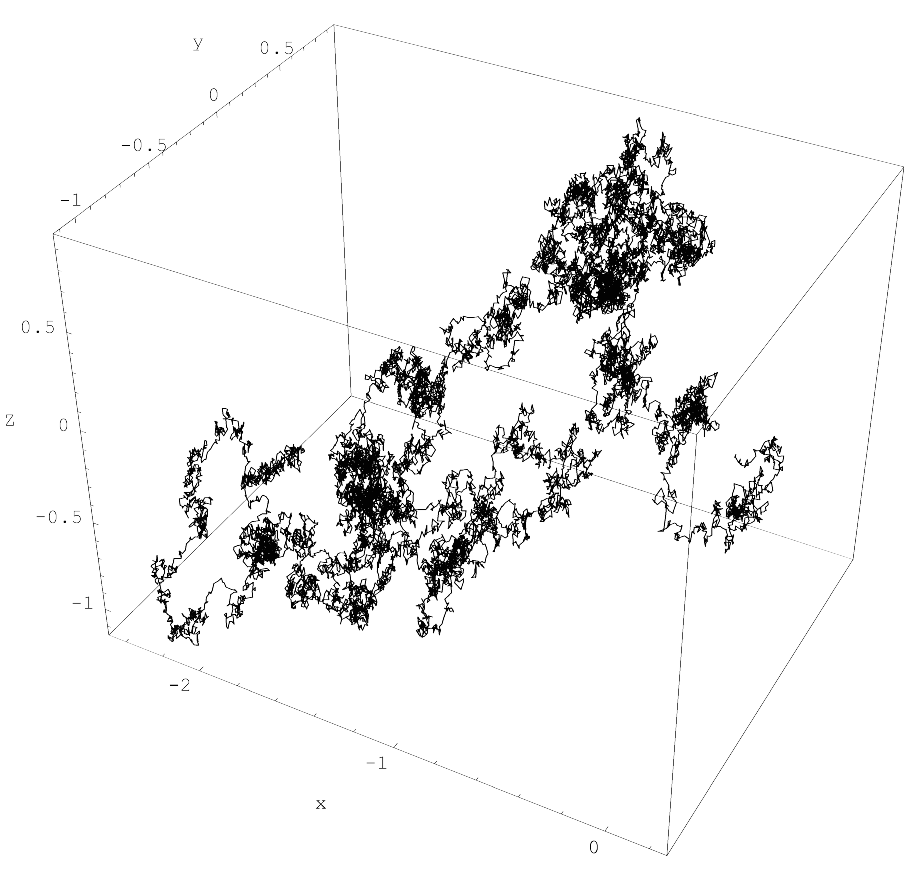

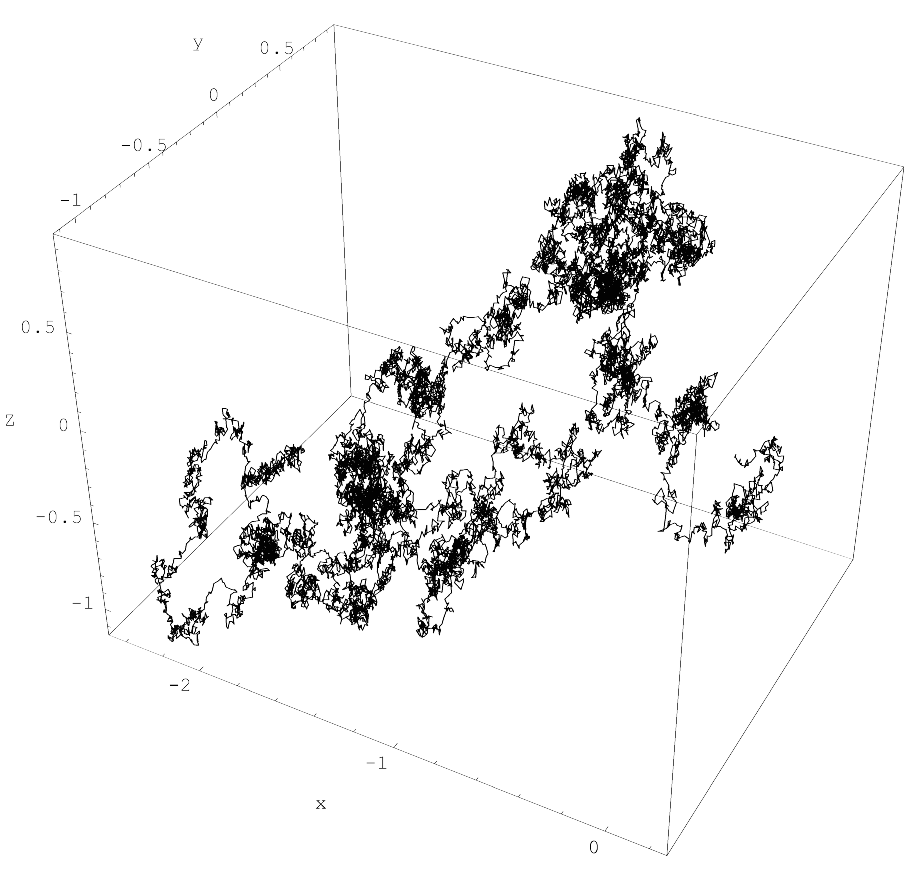

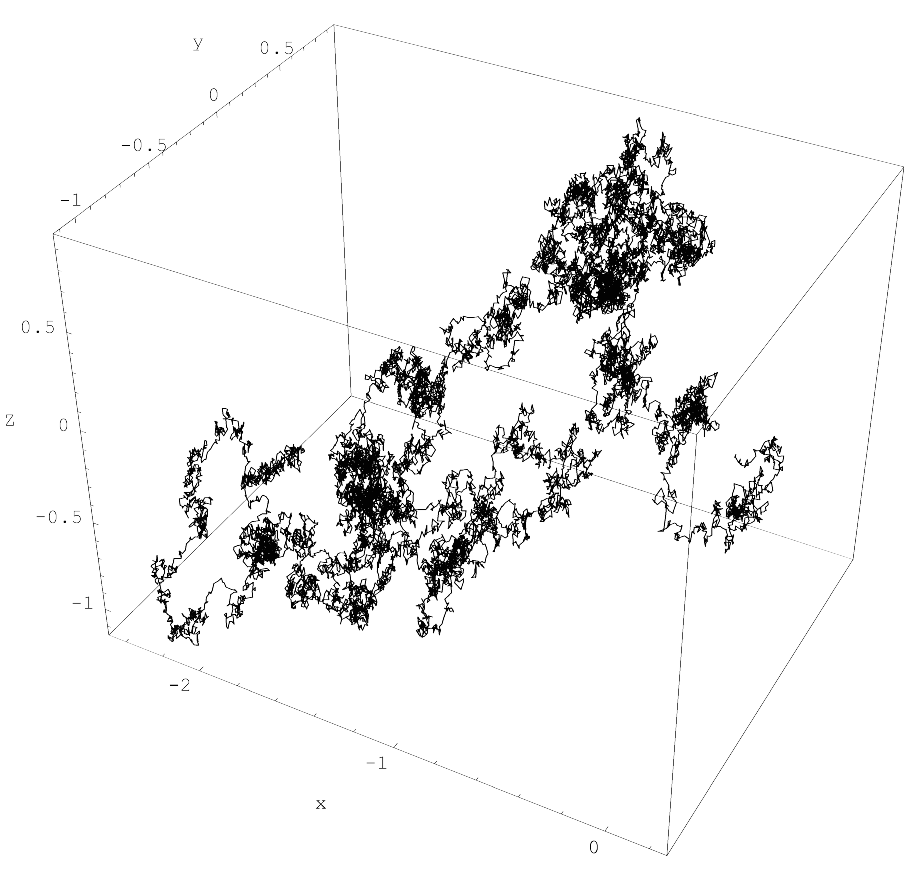

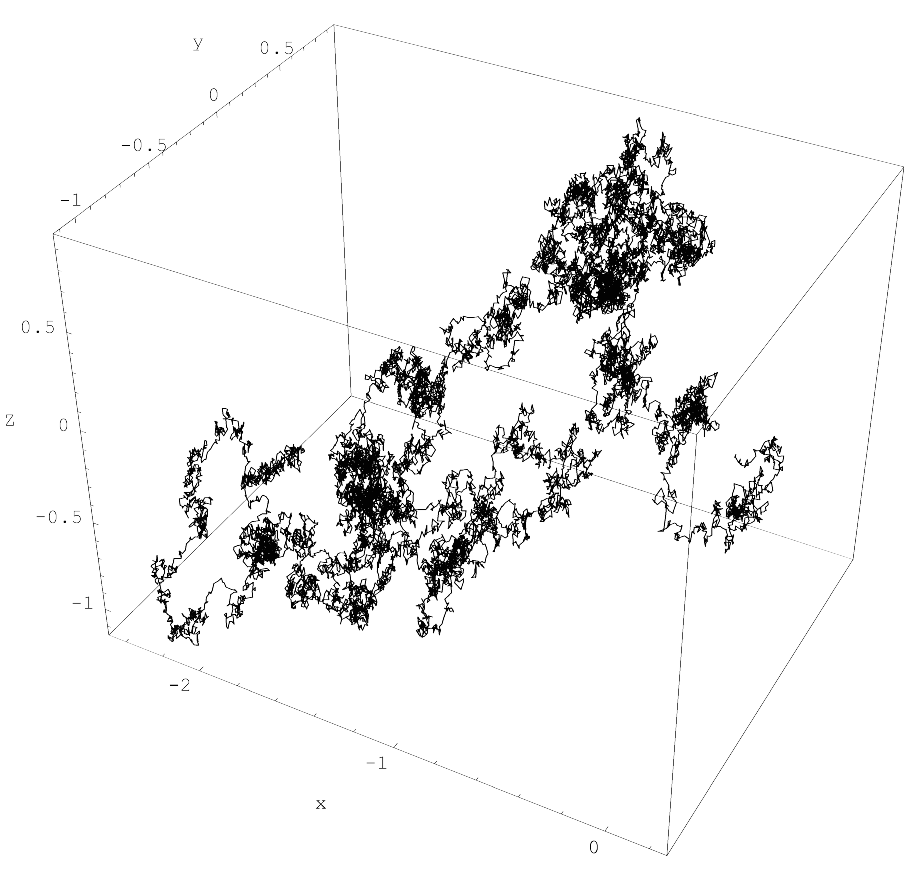

We demonstrate in this talk that rough volatility is a consequence of no-statistical arbitrage constraints faced by market participants. To do so, we connect the shape of market impact curves to the behavior of the volatility. As a by-product, we are able to understand the celebrated square-root law of market impact and to understand the role of participation rate in this stylized fact of financial markets. This is joint work with Bruno Durin and Grégoire Szymanski.

By Mathieu Rosenbaum Chair: Nakahiro Yoshida

Via Cantarane, 24 37129 Verona Italy

+39 045 802 8537